- #Mi file extension 2016 efile for free

- #Mi file extension 2016 efile how to

- #Mi file extension 2016 efile update

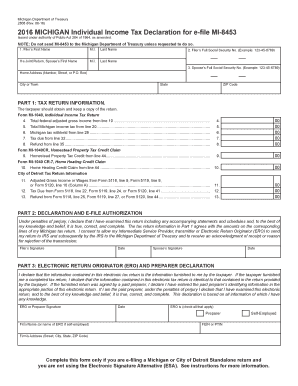

We are currently implementing T3 electronic filing using EFILE. E-filing is the most efficient way to file your federal, State and City of Detroit IIT returns. If you need a trust account number, visit our Trust Account Registration online service. MI Dept of Treasury - The Revenue Act, MCL 205.1 et seq., does not prevent a compromise of interest or penalties, or both, and further permits the Department to waive penalties where reasonable cause can be established.

#Mi file extension 2016 efile how to

For T3 electronic trust returns such as T3RET, T3ATH-IND, T3M, T3S or T3RCA to be filed using EFILE, visit How to file a T3 return along with T3 EFILE exclusions and the T3 EFILE certified software web page. E-Filing your tax return is the fastest way to get your tax refund.

Were here 7 days a week to ensure that your experience with us is as quick and simple as possible. Each year, the eFile App is updated to prepare and e-file current year returns as past year returns are not able to. Filing your tax return can be nerve racking.

#Mi file extension 2016 efile for free

T3 Trust Internet Filing vs T3 EFILEįor a list of T3 Trust returns that can use internet filing, visit the Trust Internet Filing web page for more information along with Restrictions for online filing. E-File Your Taxes & Get Your Refund by Direct Deposit Start Now For Free Our Features.

#Mi file extension 2016 efile update

The failure-to-file penalty is 5 of the unpaid tax, charged per month (up to a maximum of 25). Update Oct 2020: I searched in Deductions section and was unable to find it when the tool walks you through all deductions, BUT if you select Show Topic List at the top right, scroll to Deductions & Credits > Estimates & Other Taxes Paid > Federal, State and Local Estimates and Federal Taxes Paid a. Get automatic extension up to 6 months by choosing ExpressExtension as your e. Businesses operating as C-Corporation, S-Corporation, Partnership, LLC, Estate and Trusts can request an extension using Form 7004. You will still be able to receive a refund if applies, if you owe, however, IRS very likely will impose penalty and interest on your balance. To file an extension for business taxes request an extension Form 7004, automatic extension of time to file business income tax return. You can electronically file your clients 2017, 2018, 2019, 2020, and 2021 initial personal income tax and benefit returns using the EFILE service and you can file your clients amended T1 returns for 2018, 2019, 2020, and 2021 using ReFILE. If you fail to file for a tax extension or your tax return by the proper filing due date (March 15th, for most businesses and May 17th for most individuals), the IRS will impose interest and penalty charges on any unpaid Federal taxes, as well as penalties for filing late. It is not too late to file your 2016 taxes. The EFILE and ReFILE services are open for transmission from Februat 8:30 a.m.

0 kommentar(er)

0 kommentar(er)